There is one thing that pisses me off about financial savings articles, and that is the recap of a saver's journey.

The articles generally start with the person in question sharing their debt load, the plan they followed, and skips to the fact that they became debt free because of it X years later. That's great, but what is missing is the many years of hard work and commitment that it took to make the goal become a reality.

When boiled down to 500 words it sounds amazing that someone can pay off a big debt in a “short” period of time. We could do this in talking about how we paid off $50,000 in student loan and car debt in 33 months, but there is a little secret no one ever shares: those months or years in the middle suck.

While articles tend to shrug this off as being part of the very nature of this method (which is true), a period of several years is still a huge chunk of time. And that in-between time does not go by as quick as you'd like while large sums of money disappear every single paycheck.

But I am here to tell you today to not get discouraged- it is worth it. You just need to know a few things along the way that others are not so eager to tell you about.

A Summary of the Debt Avalanche Technique

The debt avalanche technique is a simple yet powerful way to pay off your debts at an accelerated rate, and is what we used to pay nearly $30,000 of our student loans off in 18 months and $20,000 in car payments in an additional 15 months (33 months in total).

The way it works is that you take what you are currently spending for your debts and find a way to pay more to one debt (typically the one with the highest interest rate) in order to pay it off faster. Once one debt is paid off take what you were paying on that and apply it to the next (typically the one with the next highest interest rate). Repeat this for all debts until you are completely paid off and you'll have done so in a much more rapid schedule.

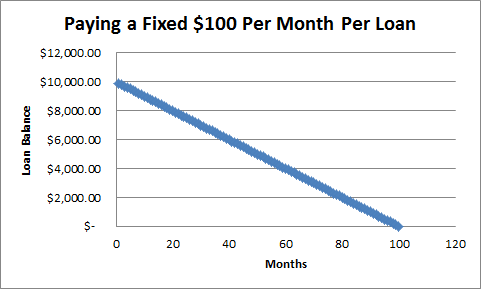

So say you have a student loan balance of $10,000, a car loan balance of $10,000, and private debt balance of $10,000. And say you're paying $100 per month on each, such that you're paying $300 per month in total and all interest is factored into this already*. This would take about 100 months to pay all three of those off (just over 8 years in this fictitious scenario).

In a perfect world it would look like this (imagine three lines being present each following the same slope):

- Loan 1: $10,000 at $100 per month = 100 months

- Loan 2: $10,000 at $100 per month = 100 months

- Loan 3: $10,000 at $100 per month = 100 months

- Total spending $300 per month for 100 months

At month 100 you're completely debt free, and now have $300 more per month to do with however you like (spend, save, get a new debt, whatever).

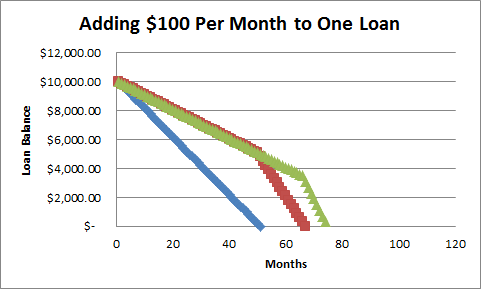

In the debt avalanche technique, you need to find more money to help pay that first loan down faster. So, let's say you can scrape by an extra $100 per month to pay off that first loan.

Now at $200 per month you can pay it off in 50 months instead of 100. Once that loan is done, you take that $200 per month you were paying, add it to the $100 per month you are paying to loan #2, and you pay the second loan off in just 16.7 more months. Now, once that loan is done, you take the $300 per month you were paying on that loan, add it to the $100 per month you are paying to loan #3, and you pay the final loan off another 8 months.

Your balances now looks like this:

- Loan 1: $10,000 at $200 per month = 50 months

- Loan 2: $10,000 at $100 per month (50 months) and $300 for remainder = 66.7 months.

- Loan 3: $10,000 at $100 per month (66.7 months) and $400 for remainder = 75 months

- Total spending: $400 per month for 75 months.

You've now taken that 100 month payback period and knocked it down to 75 months. You're now debt free two years early and have an extra $400 per month at your disposal to save or do as you wish over those two years (which amounts to just under $10,000).

If you can find an extra $200 per month at the beginning you'll have your loans paid off in 60 months. If you can find an extra $300 per month it becomes 50 months, and so on.

This is why the debt avalanche technique is so powerful as you not only pay your debt of faster, you also come out with a fair bit of extra money at your disposal at the end. But at the end of the day a 50 month pay down period is still painful during those 50 months, and that is worth talking about further.

*Note: We know that interest will change the way our graphs and payback periods look. But the premise is still the same. We're assuming the payments above factor in interest for simplicity's sake. But it is worth noting when you pay off high interest loans rapidly, you will save a lot on interest in the long run as well. We care less about this than we do freeing up income, which is why we're not talking about it in this guide.

The Mental Toll is Very Hard to Get Started

I'm not going to sugarcoat anything here, getting into the debt avalanche mindset is mentally exhausting. Seriously!

If you're like most normal people, the vast majority of your savings comes out of your paycheck each and every week and you are never the wiser to having had that money in the first place. You take the rest for your bills, maybe make some small splurges, and, if you're lucky, perhaps save some of what is left over for a rainy day or a major purchase.

Switching this around to save an extra $50, $100, $250, or even $500 per month to pay down your debts via the debt avalanche technique can put a strain on your current lifestyle.

Do you take a vacation this year or save? Do you buy the laptop you've been eyeing or wait a few more months for the price to come down? Do you go out to eat tonight or keep it to put money to your loan? If you are going at the debt avalanche technique aggressive enough everything becomes a burden, whether you can afford it or not, and multiply that over many years and you can imagine the kind of stress it produces along the way.

So we can safely say, getting started on the debt avalanche technique is akin to emotional abuse- and it is one you're giving yourself.

The High of the Payoff Keeps You Going

Thankfully, there is some point in the debt avalanche mindset where it all clicks. I'll be honest in that it doesn't happen until you start seeing the first debt winding down, or maybe even beyond that once you wave goodbye to the first one for good. But once you do you get a high that is unlike no other.

When that $10,000 debt becomes $5,000, and then becomes $2,500, and then becomes $500, you start feeding off of it like an addiction, getting joy out of watching that number decrease. There is still no return for you at this time in the traditional sense, but the high certainly does come and makes you actually enjoy spending the money on removing the debt.

We certainly felt this way after a while, and to further the point we wanted to share our own debt schedule as a real-life example.

We began 2016 with over $60,000 in debt between our cars and student loans. Yes, that is a lot.

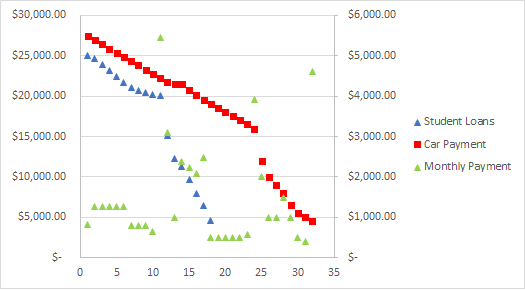

We started our debt avalanche quest around June 2016 with about $55,000 in debt (month one on the graph below), finished the roughly $25,000 or so in student loans in December 2017, and paid off close to another $25,000 of our cars by the end of 2018.

Visually, our pay off structure looks roughly like the following- updated to Month 32 (November 2018):

To walk you through this chart, we have to break it up into different sections:

- Month 0: This graph begins in June 2016 where we had roughly $55,000 in debt, an average monthly spending of $890 per month on those debts (green line, right y-axis), and we decided to start paying our student loans (blue line) faster to the tune of an extra $400 to $500 per month.

- Month 6-10: We were also saving for a house during these months and by month six we had to go back to close to our minimum payments in order to meet our house down payment goal. The first year ends in June 2017 shortly after we bought a house.

- Month 10-18: Around this time we had $7,500 extra from our house down payment that we applied to our student loans (months 10 and 11 spikes in monthly payment). We then took a mix of the extra money we were saving for a house deposit (~$500 a month), plus extra blog earnings (~$1,000 a month), and began applying it to the remaining balance of our student loans which resulted in a drastic shift in our payoff schedule. We paid off the final student loan in December 2017, roughly 18 months after starting and a few months sooner than projected.

- Month 18-35: Now that we finished our student loan payments, we took most (but not all) of that remaining money plus additional blog earnings to pay down the balance for our cars. Jeremy's car was fully paid off by the end of 2018, and we have opted to keep the remaining balance on Angie's (well under $4,000) and pay it off at a slower pace.

When it is all said and done, we took a five-to-six year payback period for most of the loans and condensed it to just under three. Even better? We now have even more money to play with every month as a result!

Our schedule was vastly accelerated over most, and even we have to say, those years in between were not the most fun. Yes, we saved and bought a house during this time. Yes, we also took a vacation or two. We even grew our business quite a bit as well by reinvesting some earnings.

But when it was all said and done we put every last penny beyond normal savings into paying down these debts, and no matter where you start from you will feel it if you are being aggressive enough. Whether it is as low as an extra $100 per month, or high as an extra $3,000 per month as we're projecting by the time we finish, there is always something more enjoyable you could be doing with that money.

I would've loved to go on more vacations. I also would've loved to make upgrades to our house all at once instead of spacing it out over several months. Heck, I would be happy going out to eat more often than we already do, too. But every time we think of ways to spend the money we had coming in, we have to keep reminding ourselves of the greater good, and the money is gone just as quickly as it comes in.

Waving goodbye to it each and every month is a necessary evil, one you have to do for a very, very long time. And when it comes down to it, the mental hurdles you face in the meantime are often the hardest part.

We can see why no one talks about it.

Disclaimers: Our site uses demographic data, email opt-ins, display advertising, and affiliate links. Please check out our Terms and Conditions for more information.